Contents

The movement of prices is directly affected by supply and demand, and it’s really the only thing that matters when it comes to day trading. Because of this supply and demand factor, it’s important that you realize and understand how supply and demand affect price action. Can be seen as a strategy to understand the zones in which you can look to enter into trades.

However in the forward segment, sales of forward dollars continue to outstrip purchases. 4) The range of a spread trade is relative to that particular security market, it’s not same for all. These are significant price movements in the corresponding directions, they are depicted with long candles. Hello All, For long time I have been getting a lot of requests for Support/Resistance Multi Time Frame script. Here ‘ Support Resistance Channels/Zones Multi Time Frame ‘ is in your service.

Instead, you’ll know to use all of the available market data on a stock to produce high-probability trading setups. Both “good” and “bad” companies saw their share prices drop. And of course, you’ll also find stock in companies with strong fundamentals that are completely ignored by investors when the market is stable or moving higher. In trading we are looking for more precision and high reliability levels to trade from.

Enjoy exclusive supply and-demand-forex as well as popular videos and films. Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events.

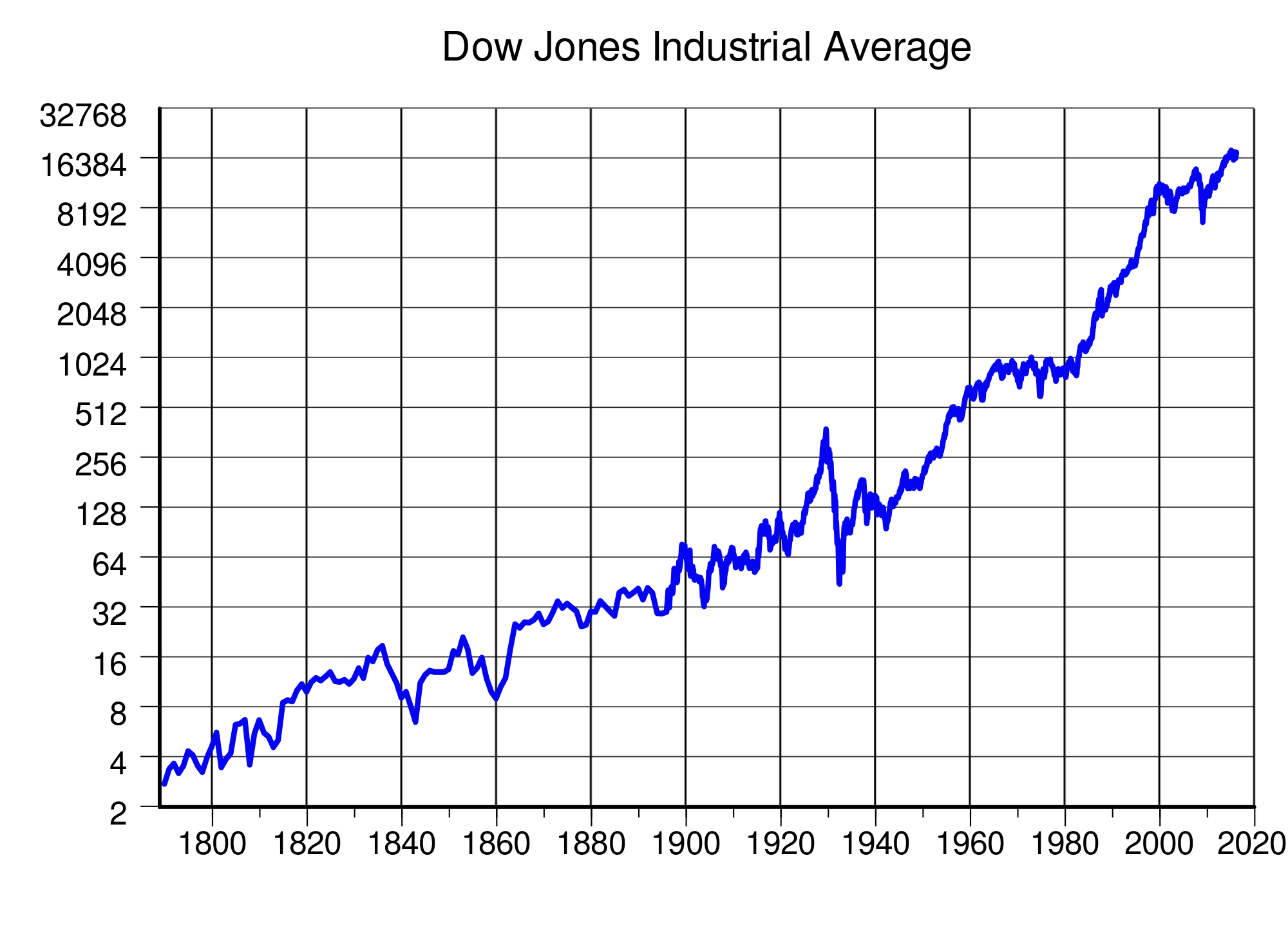

Seeing your position move into gains or slide into losses has a huge impact on whether you choose to continue to hold shares or sell them. They’re the prices paid by tens of thousands of individual investors. So as a result, the decision making of those investors is based almost entirely on past prices.

Supply and demand trading strategy: what to look for

In this three-part series, I summarise the findings. In the first blog I outline the current situation and the reasons for the forex shortage and the resulting backlog. In the second blog I talk about the current imbalances in the economy due to the overvaluation of the kina, how big that overvaluation is, and what would happen if the kina depreciated.

- In this guide, we will provide you with all the basic information about it and will show how to determine the zones mentioned correctly step by step.

- There are also traders’ requests waiting for favorable conditions for purchase.

- Day traders may need to watch for breakout formation of rectangular ranges when markets open or close when liquidity or volatility are higher relatively.

- In sum, determining supply/demand zones is a crucial stage of market analysis.

- The main aim of this indicator is to identify the overbought and oversold zone.

The broader coverage ensures that you can assess price movement in the future more reliably than a single level or line in the case of S&R.

Domestic firms with foreign owners must return their share of profits to their foreign partners/owners. The view amongst foreign investors, exporters, and others wishing to repatriate funds to PNG is that a depreciation is likely at some point. The response to this expectation is to hold funds offshore until a depreciation has occurred to avoid capital loss.

Top 10 Forex Indicators That Every Trader Should Know

The moving average is one of the forex indicators that is the average price of the last number of candles that represent the overall sentiment of the price. The concept of moving average is very important that every trader should know. The central bank and multinational companies drive the forex market. Therefore, it is important to understand what is happening at the macro level. Supply and demand zones are spread across a wider area than support and resistance levels. MACD is a trading indicator that consists of a histogram and an exponential moving average.

Technical/Fundamental Analysis Charts & Tools provided for research purpose. Please be aware of the risk’s involved in trading & seek independent advice, if necessary. I would like to oppose the idea of kina depreciation, as it would have a negative impact on our economic activities, especially our exports and our balance of trade account ultimately. Given the backlog, to avoid queuing to have their forex orders cleared, PNG-based businesses return the minimum required amount of forex to PNG.

“Gujarat Day” In The Supreme Court

This determines the rate at which PNG can convert exports (PNG’s surplus goods sold to buyers overseas) into imports . A fall in the terms of trade means that each unit of exports buys fewer units of imports, thus reducing the supply of foreign currency. Elearnmarkets is a complete financial market portal where the market experts have taken the onus to spread financial education. ELM constantly experiments with new education methodologies and technologies to make financial education effective, affordable and accessible to all. If the price moves with a trend, corrects towards 61.8% Fibonacci retracement, and shows a market reversal, the price will likely move 161.8% Fibonacci extension level of the current leg.

Quick recap of the Wyckoff method (a more basic intro than you’d find in most blog posts) and then a similarly quick intro to supply and demand zones. The RBI announced steps to attract capital inflows on July 6, but the measures would take time to foreign currency demand-supply imbalance, economists said. The sooner you learn to read a price chart and convert over to price action trading, the better your trading results will become. Do you really think that there is an indicator, which will more than likely be basing it’s outcome on past prices, that can tell you when to enter and exit a market? The new and improved Support & Resistance Zones indicator is here. This indicator is based on high volume at fractal lows or fractal highs with the zones based on the size of the wick for that timeframe’s candle.

There he teaches you how to identify supply demand levels, the rationale behind them and how to trade them. The supply zone will be presented by upward candles, the demand https://1investing.in/ one ― by downward ones. Hello Traders, Linear Regression gives us some abilities to calculate the trend and if we combine it with volume then we may get very good results.

Furthermore, a market rejection from the Parabolic SAR indicator provides a potential entry point. If the price moves above the 70 levels, the price will likely reverse. On the other hand, if the price moves below the 30 levels, it creates the possibility of a bullish reversal. Overall, this trading indicator is very easy to use and provides a reliable trading entry. 2) There should be some friction in demand-supply of that security, because that creates chances for a wider spread. Watch full collection of movies about supply and-demand-forex from india and around the world.

Read the full report on PNG’s foreign exchange market, which includes a guide for less technically minded readers, here. The shortage of forex is caused by a structural imbalance between demand and supply in the forex market – that is, low supply and high demand. In every financial market, the increase of volatility indicates the market reversal, and the decrease of volatility indicates the market continuation. The Kumo Cloud is the first element of this indicator that helps to understand the market context. If the price is trading below the Kumo Cloud, the overall trend is bearish, and above the Kumo Cloud is bullish.

Customers who read this book also read

To simplify accumulation – a stock that’s bullish is indicative of high demand and is seeing accumulation. Similarly, a stock that’s bearish shows greater supply than demand and is showing distribution. The Devpolicy Blog is based at the Development Policy Centre, Crawford School of Public Policy, College of Asia and the Pacific, The Australian National University. Insightful news, sharp views, newsletters, e-paper, and more! Unlock incisive commentary only on Business Standard.

Gil Ben-Hur is the founder and CEO of The5ers Funding Traders & Growth Program. The5ers Fund forex traders with 100% trading capital, 50% profit share, and 10% net gain target milestone to double the account size. In the series of webinars we will dive deep into the core of the Supply & Demand theory and practice. We will study the anatomy of price action according to the rules of Supply & Demand. We will least now to easily spot high probability entry levels, time our trade for precision, plan and manage risk. For the past decade Supply & Demand had bought a high reputation as an advanced and accurate price action trading methodology.

This indicates that demand and supply from the corporate sector is more or less equal. This is perhaps the most significant development noticed this month given that during March and April, the markets were flush with demand and supply forex dollars leading to a strengthening of the rupee. The amount of dollars flowing into the banking system from the merchant segment then were much lower than the amount of outflows to that segment in March and April.

Introduce yourself for the Supply & Demand trading theory. It is straightforward to understand, easy to read, very visual, but most important, it is a timeless concept. I have posted this zones of demand and supply as charts are missing i’m just reposting this..nothing new nor it is a standalone trading system… This script finds pivot highs and pivot lows then calculates higher highs & lower lows.

Parabolic SAR indicates the market trend of a currency pair. If the price is above the Parabolic SAR, the overall trend is bullish. On the other hand, if the price is below the SAR, the overall trend is bearish. The lower Average True Range indicates the lower volatility and the higher ATR indicates the higher volatility. Therefore, if the volatility is low, you can extend your take profit.